This section is one of the most important sections you will need to know about FOREX trading. Why is this important?? We want to earn money in our business, and in order to make money we have to learn to control it. Funnily enough, is this a topic that often goes more or less unnoticed. Most traders strive to make profitable trades without regard to the size of the account. You simply decide on the risk of the individual trade and press the “Buy” or “Sell” Button. There is a word for this type of investment, we call it “Play or gamble”!

When you trade without money management rules, are you indeed a player. You don't look at what jumps out of your investment over a long period of time. Instead, you are looking for the “Jackpot”. Money management rules don't just protect us, They will bring us profit over a longer period of time. If you don't believe me, and are of the opinion that “Gambling” the way is to get rich, then consider this example:

Many people go to Las Vegas, to play with your money in the hope of the “Jackpot”, and in fact, many of these people also win. But as in the whole world, casinos still make so much money, if individual persons “Jackpots” win. The answer is, although individual “Jackpots” win, casinos are still profitable over a longer period of time, because you can count on more money from those who just don't win. Hence the saying “The house always wins”.

In reality, casinos are very rich statisticians, who know that over a longer period of time you are the ones who earn the money and not the gamblers. Even if one comes and at the slot machine the 100.000$ wins, the casinos know that there 100 other players will come and won nothing and the money will come back into the pockets of the casinos.

This is a classic example of how statisticians make money as opposed to players. Both occasionally lose money, only the casino or the statistician, knows how to control his losses. Basically, this is how money management works. When you learn to control your losses, you have a chance to become successful.

Do you want to be the rich statistician and not the gambler, because then you will always be among the winners over a longer period of time.

The next question we are trying to answer is: How do we become a rich statistician instead of a loser.

Maximum drawdown

Now we know that money management lets us make money over a longer period of time, but now I want to show you the other side. What happens if you don't use money management rules?

Here is an example:

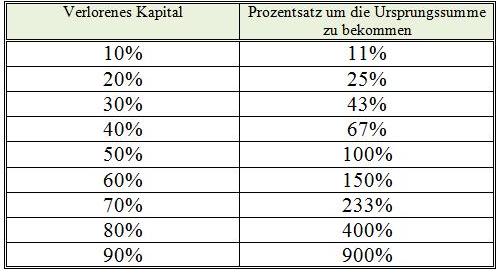

Let's say you have 100.000$ You lose 50.000$. What percentage of your balance have you lost? The answer is 50%, Easy. And now, what percentage of the 50.000$ you need to earn for your original 100.000$ to get. They are not 50%, but you have to 100% to your 50.000$ earn to return to 100.000$ Arrive. This is what we call a drawdown. In this example, we had a 50% Drawdown.

What we learn from this example is that it is very easy to lose money but much harder to earn it back. You're probably thinking, "I'm not going to 50% lose my capital on a trade". We assume that this will really never happen.

But what if you 3, 4 or even 10 Losing trades in a row? Now you're probably thinking, that this can't happen to you. You have developed a trading system that is available at 80% that brings profits to trades, it can't be that you 10 Losing trades in series. I'll tell you, It is very, very unlikely, but it can happen.

Even if you have a good trading system, consider this example:

When trading, we try to cross a threshold. This is the reason why traders develop trading systems. A system that leads to 80% Profit yields sounds like the threshold is very high, super. But because your trading system is too 80% Success brings, this also means that you always 8 from 10 Win trades?

Loser Track

Not necessarily! How do you want to know which of the 80 Trades from the 100 the profitable ones are? The answer is, that you simply can't know. You can use the first 20 Lose trades in a row and then the rest 80 win. Your trading system would still have a 80% Rate, but you should ask yourself "Do I continue to act if I 20 Lost trades in a row?"

Why money management is so important. No matter what kind of system you use, You can also get on the losing track. Also professional poker players who live from poker, are sometimes on a terrible losing track, but still, you end up being the one with the fat wallet.

The reason is, that good poker players operate money management, You know you won't win every tournament you play. These people only risk a small percentage of your capital, this allows you to survive even longer loss distances.

This is what you should do as a trader. Risk only a small percentage of your trading capital, so that you can survive a lost route. Remember, if you stick to comply with your money management rules, you become a casino for a long time and you know "The casino always wins"!"

Don't lose your last shirt

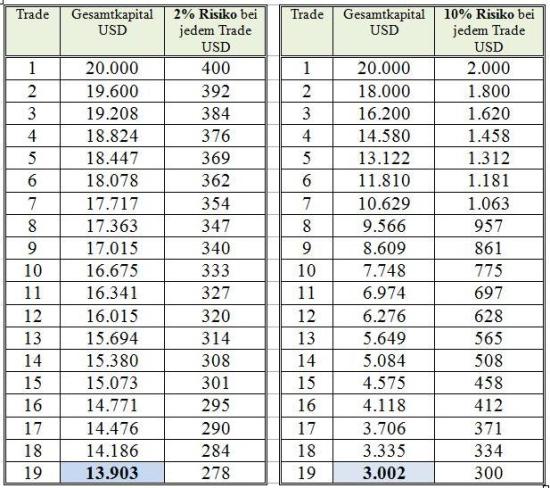

Indication of this table you can see the difference, whether you risk a small percentage or whether the percentage is higher.

You can see that there is a huge difference between the risk of 2% compared to 10% of your trading capital that you risk on every trade. Should it occur, that you are on an incredible losing track and you 19 Losing trades in a row, then you would have with a starting capital of 20.000 USD, a risk of 10% with every trade still 3.002 USD on your trading account. So you would have had over 85% lost.

If there is a risk of 2% on any trade you would still have 13.903 USD, the loss is therefore only 30%.

Sure, the last thing we want is 19 Losing trades in a row, but even if you only 5 Losing trades in a row, see the difference between a 2% and a 10% Risk. With 2% You would still be at risk 18.447 USD. Would you have each 10% only more would be risked 13.122 USD da. This is less than if you were at 2% Risk 19 Trades would have lost in a row.

What we can learn from this example is, that you should set up your money management rules in such a way that you can even after longer drawdown periods (Loss of routes) have enough capital left to stay in the race. Can you imagine 85% Losing your capital? You would then have to deal with the rest 566% Make a profit to return to your original 100% to be obtained. But believe me, You never want to get into this situation.

This table shows, what percentage you have to earn to return the original 100% to get, after you have lost a certain percentage of your capital.

You see, the more you lose, the harder it will be to reach your original account balance. That's why you should do everything you can to secure your capital. I hope you now realize that you should only risk a small percentage of your capital on each trade, so that you can survive even a possible loss. Furthermore, you should avoid major drawdowns on your account. Remember you want to be the casino, and not the player!

Summary

Be the casino and not the player. Remember, Casinos are very rich statisticians. Drawdowns are the reality, You will have to deal with it. The less you risk in a trade, the lower your maximum drawdown will be. The more you lose of your trading capital, the harder it will be to earn the money back. Trade only a small percentage of your account at a time.