Meanwhile, there are already some tools in your FOREX- Toolbox. In this chapter we will add one more: Chart Pattern!

Let's compare chart patterns with a mine detector, if you have understood this chapter, you will be able to “Price explosion” to be recognized before it takes place. You will make a lot of money with it.

In this chapter we will show you chart patterns and formations. Correctly detected, this is usually followed by a strong outbreak or, in our case, a “Explosion” in Price History.

Think of our biggest goal, we want to detect large price movements before they occur, so that we can take advantage of the trend for as long as possible to make as many beeps as possible. Chart patterns will be a great help to us to recognize conditions, where the market is ready for an outbreak.

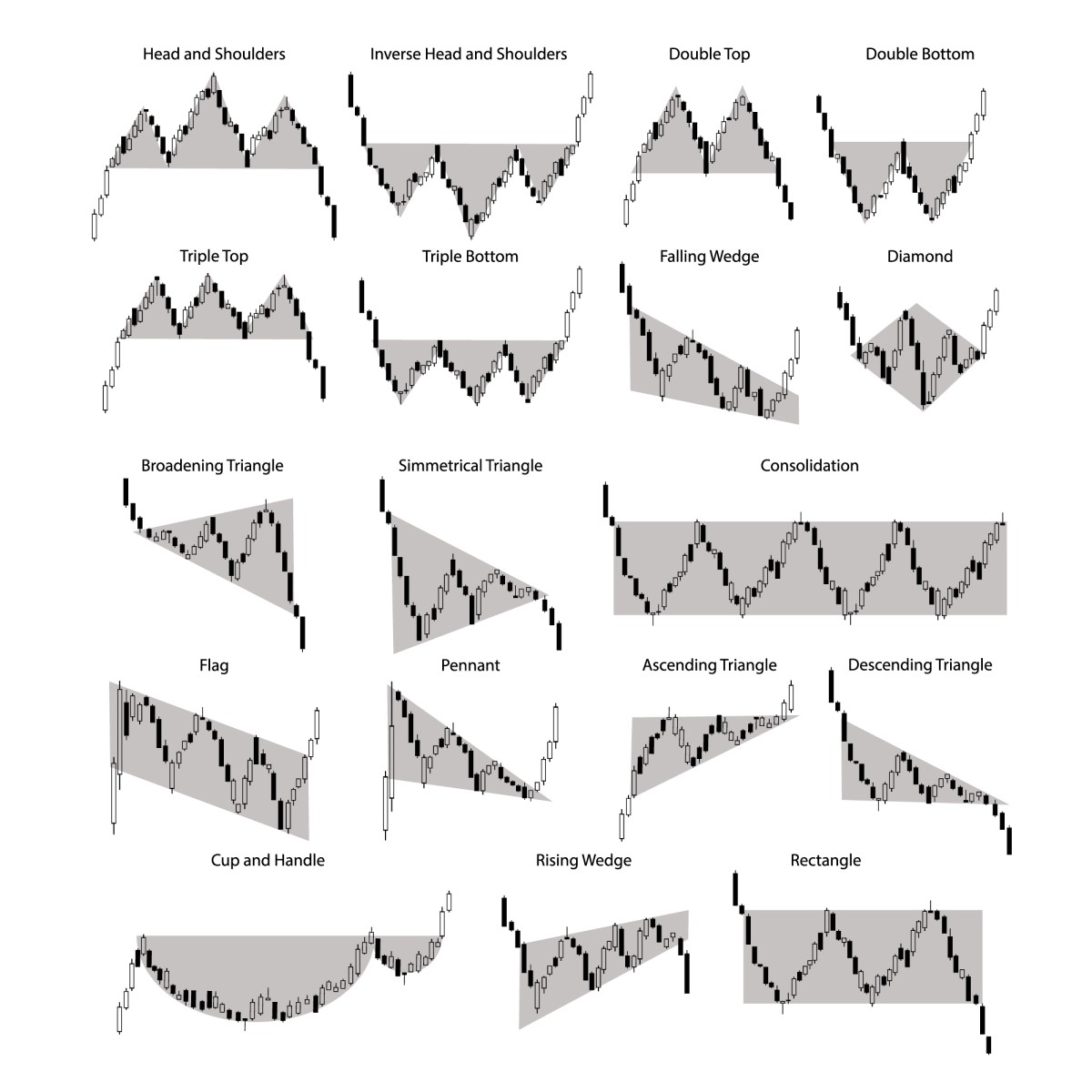

Here is a list of patterns, that we will talk about:

- Symmetrical Triangles (Symmetrical triangle)

- Ascending Triangles (Rising triangle)

- Descending Triangles (Falling triangle)

- Double Top (Double tip)

- Double Bottom (Double low point)

- Head and Shoulders (Head and shoulders)

- Reverse Head and Shoulders (Inverted head and shoulders)

Symmetrical Triangles

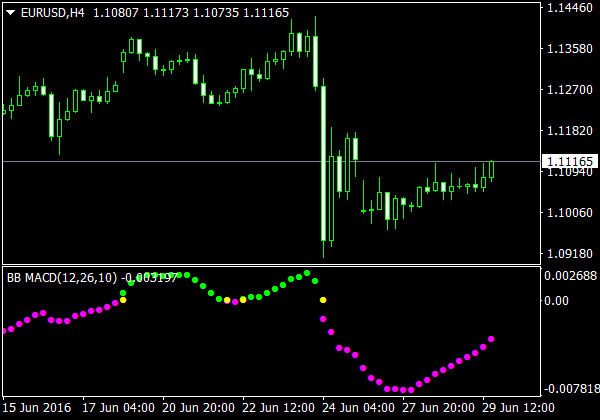

Symmetrical Triangles (Symmetrical triangles) chart patterns where the peaks of the highest- and the lowest prices converge with the same slope, so that a pattern is created that looks like a triangle. What happens in the market when the maximum prices fall and the lowest prices rise? Such a formation tells us that neither the buyers nor the sellers push the price strongly enough, why there is no clear trend. If this were a battle between buyer and seller, then the result would be a draw.

This activity on a chart is called a consolidation or merger.

On our chart you can see, that neither the buyers nor the sellers could push the price in their direction. When that happens, we get lower highs and higher lowest prices. Are the two lines approaching, we can assume, that we are about to experience an outbreak. We do not know in which direction the eruption will go, but we know it will happen.

How can we use this knowledge to our advantage? We determine two possible entry points, the first above the line of maximum prices, the second below the slope line of the lowest prices. Since we know that the price will break out, we can jump on the bandwagon no matter in which direction it goes.

In this example, we have defined an entry order above the falling line of maximum prices, so we can take full advantage of the subsequent upward trend. If you had defined a second entry order below the line of rising rock prices, you would delete it as soon as the first entry condition has been reached. (Perhaps read the topic of order types again.)

Ascending Triangles

Ascending Triangles (Rising triangles) are formations that occur when there is a resistance level and a slope of the lowest prices. During this time, a certain level seems to have been reached, which buyers can't seem to exceed. But the price somehow rises, which is evident from the higher lowest prices.

In the chart you can see that buyers are starting to get stronger, as the lowest prices increase. Buyers continue to press against the resistance level, the whole thing will lead to an outbreak. Now the only question is, in which direction the eruption leads. – Will the buyers be able to exceed this level or will the resistance level be too strong.

Statistics will tell you, that in most cases the buyers will win the battle and the price will break out above the resistance level. From experience we can say, that this is not always the case. Sometimes the resistance level is just too strong and there is not enough purchasing power to penetrate it.

Most of the time, the price will actually break out upwards. The point is, we don't want it to matter anymore in which direction the price breaks out, because we are ready for price movements in any direction. In this case, we would define an entry price above the resistance line and a second below the slope of the lowest prices. In our example, the buyers would have won, we would have bought just above the resistance level and a good trade would have come out of it. As soon as we execute the purchase order, we delete the second order.

Descending Triangles

How you might think, descending triangles are (Falling triangles) the exact opposite of Ascending Triangles. With Descending Triangles there are a number of lower maximum prices which form the upper line. The bottom line forms a support level that the price can't seem to break.

On our chart we see that the price generates ever lower maximum prices, what tells us that the sellers are getting stronger. Under normal circumstances, the price will now break through the support level and continue to fall.

But it can also happen, that the support level is too strong and the price rises afterwards. The good news is, that we don't care in which direction the price goes. We only know that the price will break out in one direction. Again, we define two possible entry options, a sell order below the support line and a buy order above the line of maximum prices.

In this case, we would have executed the sell order and deleted the purchase order. Attached remarked, the market tends to fall faster than to rise, what does it mean you usually make more money with short positions.

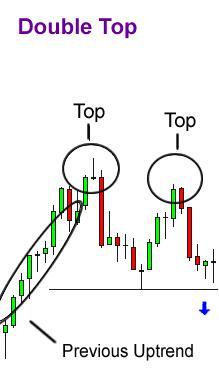

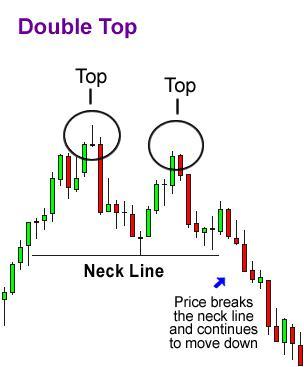

Double Top

A Double Top (Double tip) is a reversal pattern, it follows an extended upward movement. The tops are peaks that occur when the price reaches a certain level, which cannot be exceeded. When this level is reached, if the price falls at short notice, but then tries to break through the level again. If the price drops again, we get a double top.

In our chart you can see that two peaks or tops have formed after a strong upward movement. We also see that the second peak was not able to exceed the first. This is a strong sign that a trend change is imminent, since this pattern tells us that there is hardly any purchasing power left.

For a double top, we define the entry time under the “Neck Line” as we expect a reversal of the upward trend.

It seems that we are right every time. If we look at the chart, we see that the price of the “Neck Line” breaks through and makes a strong movement downwards. We remember, Double Tops are reversal patterns. We are looking for strong upward trends.

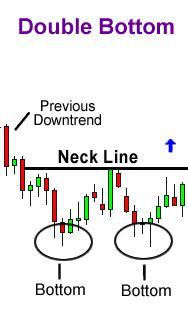

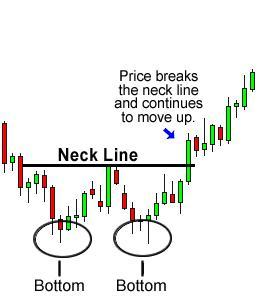

Double Bottom

Double Bottoms (Double reason) are also patterns that indicate a trend change, but this time we are looking for the right time for a long position instead of a short position. This formation is formed after extensive downtrends, if two low points or “Bottoms” appear.

How to see from the chart, two valleys arise after the downward trend because the price was not able to fall below a certain level. We also notice that the second low point is not significantly below the first.

This is a sign that the pressure of the sellers is running out, and a change of trend is imminent. We would set the starting point for a buy order above the “Neck Line” define.

Now take a look at this! The price broke the neck line and then made a good upward movement. Like double tops, double bottoms are also reversal patterns. You are looking for a strong downward trend.

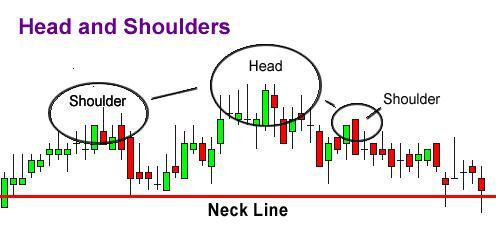

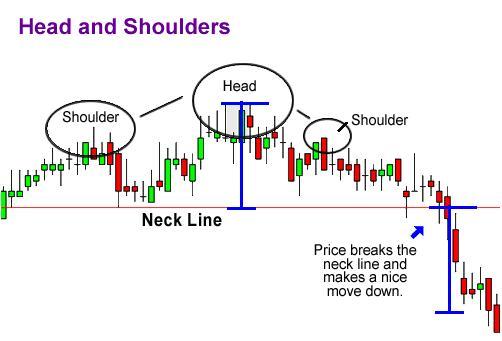

Head and Shoulders

A Head and Shoulders (Head and shoulders) Pattern is just as much an inverse pattern. It consists of a tip (Shoulder), a second higher peak (Head) and another deeper tip (Shoulder). One “Neckline” is drawn by connecting the two low points between the shoulders. The slope of this line can be reduced to- as well as downwards. In general, a downward pointing neckline brings a more reliable signal.

Here we have an example of a Head and Shoulders pattern. The head (Head) is the second tip, so the highest point of the pattern. The shoulders (Shoulders) are also peaks, but not as high as the head.

With this pattern, we will choose the entry time under the neckline. We can also calculate the exit price, by measuring the distance between head and neckline. This distance is about the same, which the price will fall after falling below the neckline.

You can see when the price breaks the neckline, he then makes a movement that is about the same size, such as the distance between head and neckline.

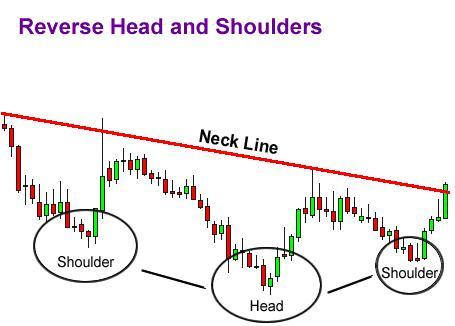

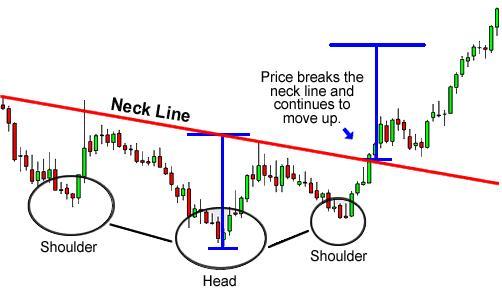

Reverse Head and Shoulders

The name, Reverse Head and Shoulders (inverted head and shoulders) speaks for itself. Basically, we have a Head and Shoulders Formation, only that the pattern is now reversed. Two low points form the shoulders, in between lies another pronounced low point, the head. This pattern arises after a strong downward movement.

Here you can see that it looks like a head and shoulders pattern, only that everything was turned upside down. In this formation, we will define a buy order with an entry price above the neck line. The exit price is calculated the same as for Head and Shoulders samples. Measure the distance between head and neckline, this is also the approximate distance that the price will cover after the breakthrough over the neck line.

You can see that the price has risen nicely, after breaking the neckline. You may think, the price continues to rise, I keep the position open, to make a little more profit. We advise you:

Never get greedy!

When the target price has been reached, you should close the position and be satisfied with your profit. There are strategies where you can see your profit and keep the trade open if the price continues to move in your direction.

Summary of Chart Pattern

Chart patterns or formations are ahead of us when the price makes a strong movement.

Triangles (Triangles)

Symmetrical Triangles (Symmetrical triangles)

- Consist of deepening highs and rising rocking prices.

- Define entry conditions above the lower high and below the higher lowest prices.

Ascending Triangles (Rising triangles)

- Consist of higher low prices and a resistance line.

- It usually means that the price breaks through the resistance level and rises. however you should define entry-level orders in both directions, in case the resistance level is too strong.

- Define the entry conditions above the resistance line and below the line of higher low prices.

Descending Triangles (Falling triangles)

- Consist of decreasing maximum prices and a support line.

- Usually this pattern means that the price breaks through the support line and continues to fall but we define entry conditions for both directions, it could be that the support level is too strong.

- We place the entry conditions above the line of lower maximum prices and below the support line.

Trend Reversal Formations

Double Top (Double tip)

- Follows an extended upward trend.

- Consists of two peaks that cannot exceed a certain level. This level becomes the Resistance Line.

- Set the time for a sales order below the low point of the valley.

Doubel Bottom (Double reason)

- Follows an extended downward trend.

- Consists of two low points that cannot fall below a certain level. This level becomes the support line.

- Set the time for a buy order above the highest point of the top.

Head and Shoulders (Head and shoulders)

- Consequences of an extended upward trend.

- Formed by three tips, the highest in the middle. A neckline is created when you connect the two low points between the tips.

- Define the conditions for a sales order under the neckline.

- We calculate the target price by calculating the distance between the maximum price (Head or Head) and the Neckline, this is the approximate distance that the price will make after breaking the neck line.

Reverse Head and Shoulders (Inverted head and shoulders)

- Comes after an extended downward trend.

- Formed by three low points, the lowest in the middle. A neckline is created when you connect the two tips between the low points.

- Define the conditions for a purchase order above the neckline.

- We calculate the target price by calculating the distance between the lowest price (inverted head or head) and the Neckline, this is the approximate distance that the price will make after breaking the neck line.