Zawsze mówiłem, że handel składa się głównie z elementów psychologicznych. Handlowcy powinni zatem spędzać na tym dużo czasu, pracować nad ich postawą. Faktem jest, że, że najbardziej “Super Trader” pracowały nad swoim podejściem psychologicznym przez co najmniej rok, zanim zaczęli opracowywać swoje plany handlowe i systemy transakcyjne. Kiedy popełniane są błędy podczas handlu, często mają one charakter psychologiczny.

Weźmy zatem “Psychologia handlu” z punktu widzenia “Błędy” widok z. Jeśli nie przestrzegasz własnych zasad handlowych, to popełnij błąd. To proste i jeśli popełnisz ten błąd w kółko., wtedy nazywa się to autosabotażem. Autosabotaż to kolejny obszar w psychologii, który oferuje szerokie możliwości, Popraw swoje wyniki handlowe.

Ale chcemy skupić się na błędach, związane z konkretną kategorią przedsiębiorców. Na początku chciałbym wam wskazać drogę, jak mierzyć błędy, które wpływają na Twoje zachowanie handlowe. Efektywność handlu powstaje poprzez pomiar, jak skuteczny jest przedsiębiorca, Przetwarzaj bezbłędne transakcje. Jeśli przedsiębiorca w 100 Transakcje popełniają pięć błędów, then he is too 95% sprawny.

Over the past five years, my Super Traders have neatly documented their mistakes, so that my team and I could take a close look at the efficiency of each trader. In the process, I found out, that the value of 95% reflects very good trading efficiency.

But some traders did not reach any 75%, a terrible value! It means, that these people make a mistake on every fourth trade. This is of utmost importance for a special type of trader, the mechanical trader. This guy believes, that he has trading problems, that can be eliminated by psychology, by trading mechanically. Many people strive to trade mechanically, let the computer make all the decisions, because they believe, thus being able to rule out all human errors.

One of my best friends once said to me, that psychology doesn't play a role in his way of trading, as its trading is fully automated. I replied: “With this method, however, you could miss a good trade.” 18 Years after this statement from me, he had to close his business. Być “Wspólnik” the computer had decided against a certain trade and this one trade would have given him the financial means for the entire year...

I always said, you can only trade your beliefs about the market. Therefore, let's take a look at typical beliefs, that a mechanical trader usually has.

- With mechanical trading, I can be objective and not make mistakes (except the psychological error, change my approach to trading).

- Mechanical trading is objective. My system allows me to determine my future results.

- Mechanical trading is precise.

- Human decision-making is too prone to error.

However, I can compensate for this shortcoming with a mechanical system.

But is mechanical trading really objective? Tak myślę, that it is not, because there are also a large number of sources of error here, that can even affect an automated trading system. Incorrect data, Faulty software, Errors in the programming of the setups etc.

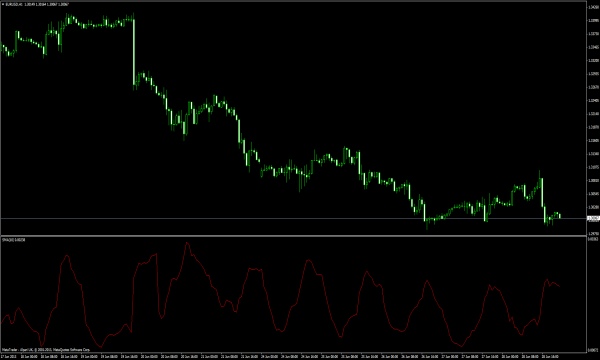

With faulty data, the trouble starts. Are your course dates always displayed correctly, or does the data flow sometimes break off, and it appears “Error”? What does their trading software do in such a case?? Will this potentially trigger a trade? In addition, historical price data may not be accurate, for example, if stock splits or dividends have not been taken into account. Mechanical traders have to deal with sources of error of this kind all the time.

Once I wanted to find out, whether I have an effective, can develop an automated stock trading system. So I looked it up “Sprawny” Shares around, bought them and secured them with a trailing stop of 25% od. I used a dataset of the S&P 500, the price information of the last 40 years included. The data seemed to be well prepared and splits and dividend payments were taken into account.

I was very pleased with the first results, because my system was making a small profit. But at that time it was not clear to me, that the system was trading on the basis of false information, because the data set allowed the system to buy shares at the respective IPO time, however, these only later became part of the S&P 500 Index.

In the back test, my system bought shares of Microsoft, eBay, Intel and many other companies – Before anyone knew, that one day she will be in the S&P 500 would be listed. Dlaczego? Because my dataset represented the state of today and this data 40 years back in time. The back test was therefore carried out on the basis of incorrect data, the profits were generated by shares of companies, that didn't even exist on the stock market yet.

The mechanical trader under the microscope

In the first part of this column, we found some sources of error, which can negatively affect the mechanical trading approach, because mechanical trading is not really objective. This is because incorrect data plays a role in this approach., faulty software and errors in the programming of the setups play an important role. In the second part, further sources of error of mechanical traders will be highlighted.

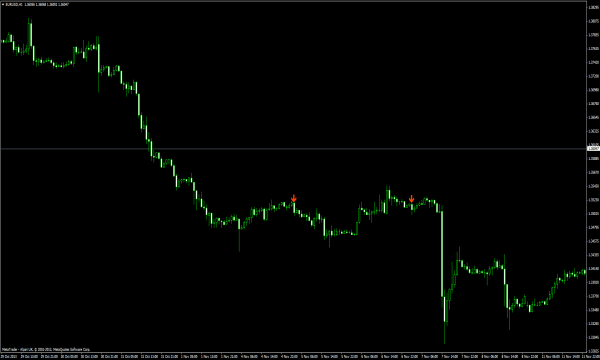

What was on the 6. Maj 2010 Actually going on? The Dow Jones lost 1000 Points in only around 20 Protokół. Blue chips such as Procter & Gamble gave over 20 Accenture's stock effectively became a penny stock. Certainly, several reasons were decisive, that this mini-crash occurred, but which also had a major impact on automated trading systems. Because a crash happens every now and then, and that's exactly the big challenge for mechanical systems, to deal with such things.

Nuta: Of course, traders without a mechanical approach were also affected by the price drop on this day. A client of mine said, he used trailing stops in the amount of 25% and yet was stopped out with every single share. But there were also traders who made big profits. Ken Long, one of our trainers, in the week of 3. aż do 7. May made a profit of 100R with his trading approach. As always, he acted very cautiously and conservatively in his trades and was very careful about it, Have risks under control.

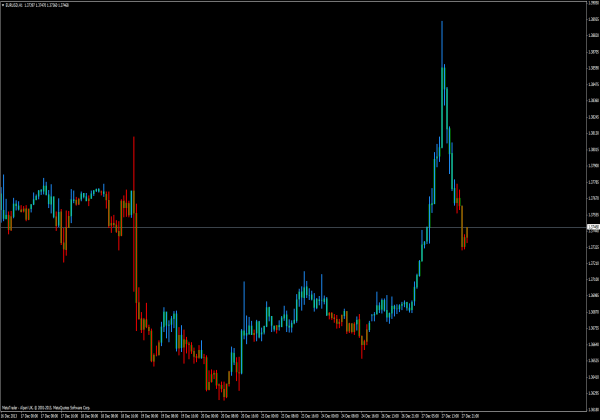

There is another category of errors in mechanical trading systems: Setting criteria that are too narrow and strict. Because the criteria of trade setups are often defined too precisely, mechanical systems miss out on many good or even great trades, that traders can easily spot with a self-directed trading approach.

Sometimes mechanical systems miss an entry into a trade, that would turn out wonderfully, just by a dot... a trader with a self-determined trading approach, on the other hand, can decide at any time, when he gets in where and even if he should make the decision intuitively. Of course, this also applies to exiting a position. Overly strict criteria when determining trade setups can sometimes be poison for the mechanical trader.

Limited options

There are a lot of sources of error in mechanical trading systems and, as we have seen, especially in the choice and setting of criteria. And that's just the point, which is crucial. Once you set their rules in a way, sometimes too precise, that a computer can execute their trades, they fall into the criteria trap. They give their program too much information, too little relevant information or do not pay attention to necessary information. Or as programmers say: “When you type crap, then only crap comes out of it.”

Therefore, their automated trading system cannot make good or excellent trades due to the strict rules, that were given to him. Due to the logic of the mechanical trading systems behind it,, As a trader, limit the actual potential or opportunities for highly profitable trades. In comparison, a trader with a self-determined trading approach, where it can vary, usually achieve better results even then, than a mechanical system, even if both use the same trading approach.

Successful Traders

Traders who determine their own trading approach are rare and are among the most successful traders worldwide. Of course, they also have a set of rules. However, these are, in contrast to the mechanical traders, Flexible and broader. I can say one thing for sure:

Each graduate of my Super Trader program is either a mechanical trader or a trader with a rules-based, self-determined trading approach. The latter have adopted Rule in their daily trading practice, that support their success.

Thus, only a small selection of stocks is analyzed and their price development is tracked. These people pay attention to strong and noticeable course corrections, also for different indices. You never risk more than 0,5% of their capital per position. They ensure, that the risk-reward ratio is at least 3 do 1 per trade is. You use trailing stops and never trade more than 4 Positions at the same time. And finally: They rethink and change their rules, if there is not at least a win of 5R at the end of the month.

Wynik

For reasons of space, I have listed only some of the rules of successful traders. But they can be sure, that successful traders have rules for all areas of trading, and these rules allow for maximum self-determination, because they can be adapted to any market situation at any time. An invaluable advantage over a mechanical approach.