Surely you have heard of it before, that the currencies of individual countries are traded on the global stock exchanges. This forex trade is called FOREX. The term “FOREX” stands for Foreign Exchange Market – trading in currencies is thus “FOREX Trading” called.

Trading in currencies became possible, after in the year 1971 exchange rates were released. Since then, the price of a currency has been determined by a worldwide network., at the approximately 300 large international banks are involved.

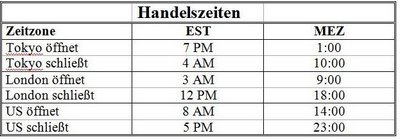

Particularly attractive in FOREX trading is the fact, that trading in foreign exchange is practically possible around the clock. Unlike trading stocks and securities, where trading hours are limited to a few hours a day, there is no such restriction in FOREX trading. Because foreign exchange is more of an abstract commodity. The trading time practically extends to 24 Hours a day and only take a break on weekends. This is based on the Central European Time and is from Friday 22 Clock up to and including on Sunday at 23 Clock. But that does not mean, that every exchange has always opened the mentioned time. Due to the different time zones, this almost 24-hour trading time results.

The currencies are always traded in pairs, such as e.B. Euro and US Dollar or US Dollar and Japanese Yen. When a purchase of a currency is planned, in return, the sale of the others always takes place.

In preschool, the introduction to this exciting topic awaits you. Here you will learn all the important terms, You will learn, how to read charts, analyzed and analyzed to make the right decisions.

What is traded on FOREX?

FOREX is the trading of foreign exchange. One currency is bought and another is sold at the same time. Currencies are always traded in pairs, e.B. Euro vs. U.S. dollar (EUR/USD) or British Pound Sterling vs. Japanese Yen (GBP/JPY). Trading is also called a broker by means of a broker, realized.

It may be a bit confusing, that you don't buy real items. Just imagine that you are buying shares of a certain country. For example, if you buy Swiss francs, in fact, buy a share of the Swiss economy. The price of a currency is a direct reflection of it, what the market thinks about the current and future situation of the Swiss economy. The exchange rate represents the economic strength of a country, compared to the economic strength of other countries.

Unlike other markets such as the stock market, FOREX is decentralized, so there is no central office that processes the orders. Trading always takes place between two parties. In general, these are two large banks. A broker acts as an intermediary between the bank and the dealer.

Initially, only the “Big Guys” Take part in this game. FOREX was originally intended for banks and large institutions and not for the “Little Boys”. Due to the rapid development of the Internet, Online FOREX trading firms are able to:, Provide accounts for each wallet.

All you need to start is a computer, an internet connection and the knowledge you will find on this website. This site has been designed in such a way, that beginners learn the essential aspects of foreign exchange in a playful and easy-to-understand way, learn.

Currency pairs on the FOREX market

In the table below you can see an overview of the most important currency pairs:

Kürzel > Währungen

EUR/USD > Euro / US Dollar

USD/JPY > US Dollar / Jap. Yen

GBP/USD > Brit. Pound / US Dollar

USD/CHF > US Dollar / Swiss franc

EUR/CHF > Euro / Swiss franc

AUD/USD > Austral. Dollar / US Dollar

USD/CAD > US Dollar / Canad. Dollar

EUR/GBP > Euro / Brit. Pound

EUR/JPY > Euro / Jap. Yen

GBP/JPY > Brit. Pound / Jap. Yen

EUR/CAD > Euro / Canad. Dollar

EUR/AUD > Euro / Austral. Dollar

GBP/CHF > Brit. Pound / Swiss franc

CHF/JPY > Schweizer Franken / Jap. Yen

AUD/CAD > Austral. Dollar / Canad. Dollar

AUD/JPY > Austral. Dollar / Jap. Yen

NZD/USD > Neuseeländ. Dollar / US Dollar

CAD/JPY > Canad. Dollar / Jap. Yen

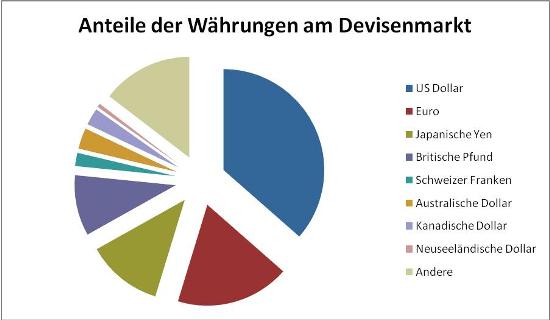

The most common are dollars, Euro, Yen, Pounds and Swiss francs (The Big 5 – The big ones 5) traded, as you can see in the following graphic:

When can foreign exchange be traded??

The foreign exchange market is open from Monday to Friday. No trading is possible on weekends. The most happens in the afternoon and evening of our time, because that's when the most action is taken. The busier it is, the faster the prices move – therefore, one should be particularly attentive to the matter at such times.

On the table below you can see the trading hours:

Why you should trade currencies

There are many advantages to trading forex. These are just a few reasons why so many people choose FOREX:

- No commissions. Brokers only receive a margin for their service, the so-called “Spread”.

- No middleman. You can participate directly in the market.

- No fixed batch sizes. The amount of capital invested can be determined individually. So you can start with very small amounts.

- Minimal transaction costs. The Costs, so the spread is usually less than 0,1% depending on the stake and leverage, it can also be less.

- Trading is 24 hours a day, 5 Possible days a week.

- FOREX is so big and has so many participants, that no one, not even a large bank can influence the market for a long period of time.

- With the function of a lever (Leverage) large sums of money can be moved even with little equity.

- High liquidity. You can buy and sell at any time, close their positions automatically or when you turn off your computer.

- Free demo account gives you the opportunity to:, to open a demo account free of charge and gain experience there without risk.