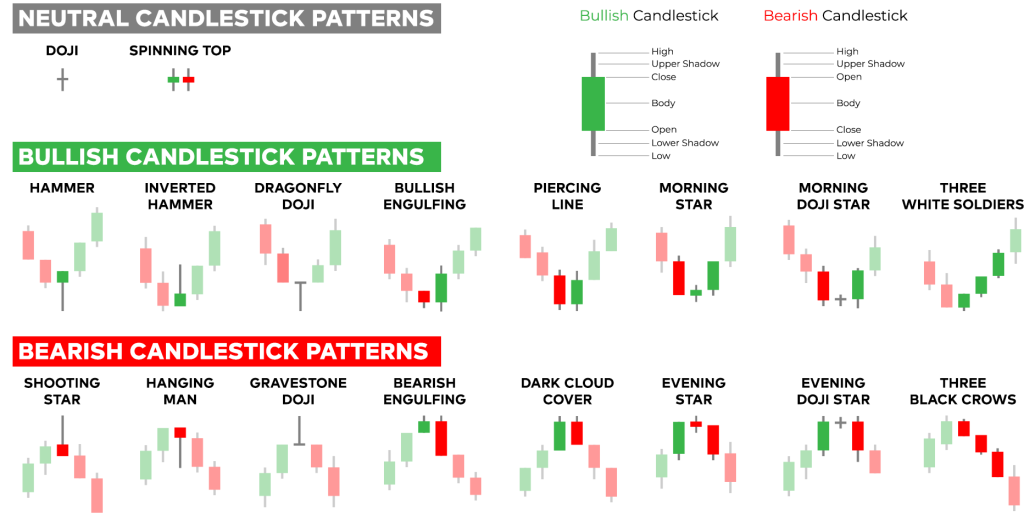

In the previous chapter, we briefly addressed the topic of candlesticks, now we will take a closer look at what candlesticks are and how you can use them for your activity as a FOREX trader. Candlesticks are originally from Japan, Steve Nison then discovered this technique for use in trade statistics..

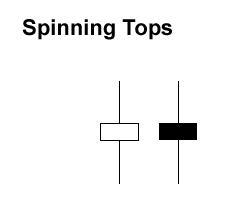

Spinning Top (Top)

Candlesticks with long upper and lower shadows and short bodies, called Spinning Tops (Top). The color does not matter. This pattern shows an indecisiveness of buyers and sellers.

The little body (whether red or green) show that only a small difference between opening- and final price is, and the shadows result from the fact that neither buyers nor sellers can gain the upper hand.

Even if opening- and final price are close to each other, the price was significantly higher and lower in between.

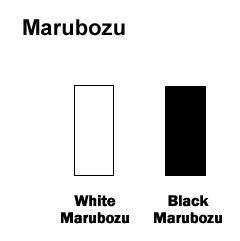

Marubozu

Sounds kind of like voodoo, but has nothing to do with it. Marubozu means there are no shadows on the bodies. Depends on whether the body is white or black, the highest and lowest price is the same as the opening- or final price.

A white marubozu consists of a long white body without shadows. The Opening- corresponds to the lowest- and the end- the maximum price. Buyers dominate the entire trading section. A Marubozu is usually the beginning of a buyer-oriented session or a sign of a reversal in this direction.

A black marubozo consists of a long black body. The Opening- is equal to the highest and the end- equal to the lowest price. The entire trading section is dominated by the sellers. The price will most likely continue to fall.

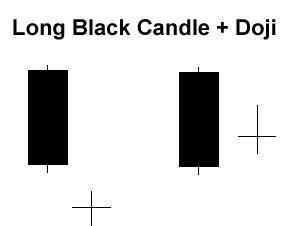

Doji

Doji Candlesticks have the same opening- and final price or at least very close to each other. A doji has a very small body, which can only be recognized as a line. Doji mean indecision or brisk trade on both sides. The price can go up and down, closes but very close to the opening price. Neither buyer nor seller can win the result is a draw, so to speak.

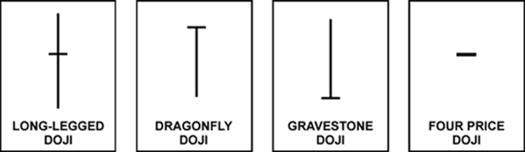

There are four special types of a Doji. The length of the lower and upper shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign.

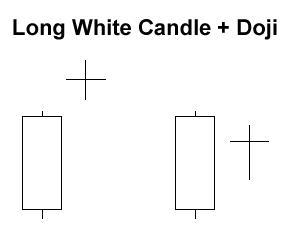

When a Doji is created on our charts, you should pay special attention to the previous Chandle. When a doji comes right after a series of long white bodies (such as.B. white Marubozus), signals that Doji is exhausted and weakening. The price will not rise any further, more buyers would be needed but there are no more.

Sellers smell the roast, start to get in and bring the price down again.

But remember, that you should not automatically go short for a Doji. A confirmation is still missing. Wait for a bear (Sale) Candle before you close or. Jump to the other side.

A doji after a series of long black bodies (such as.B. black Marubozus), signals that the sellers are getting weaker. So that the price continues to fall, more sellers are needed, but they no longer exist. Buyers see your opportunity and jump on the bandwagon.

At this time, even more buyers are needed to reverse the trend. Wait for confirmation by a white candle, before you close your sell order.