There are three different types of charts:

- Line Charts (Line chart)

- Bar Charts (Bar graph)

- Candelstick Charts (Candlestick chart)

Let's take a look at the charts in detail now….

There are three different types of charts:

Let's take a look at the charts in detail now….

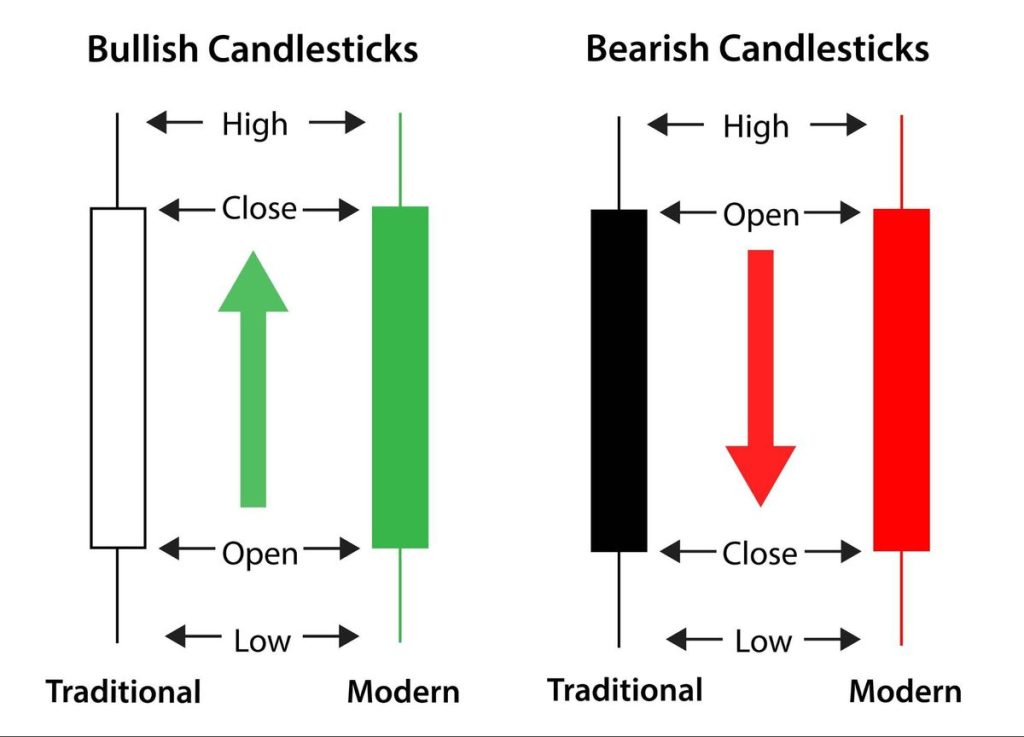

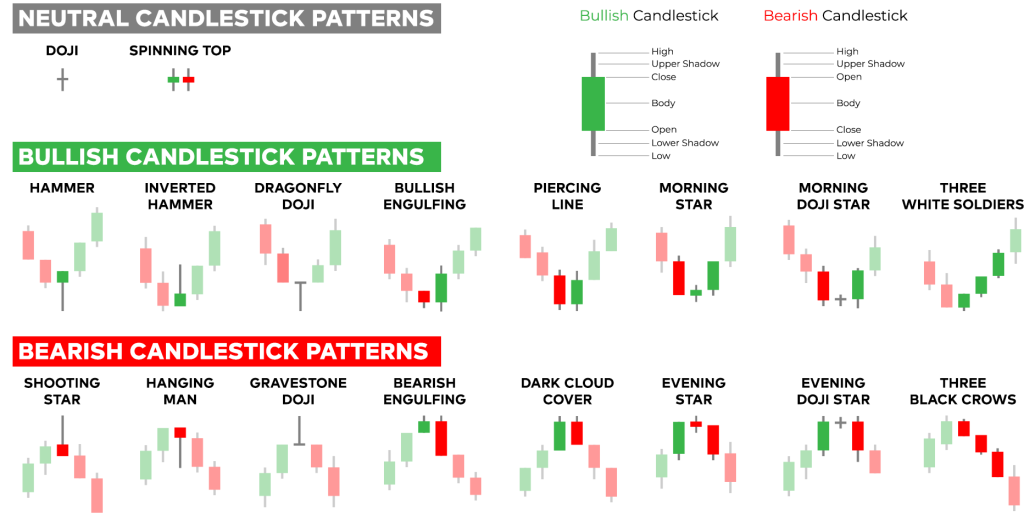

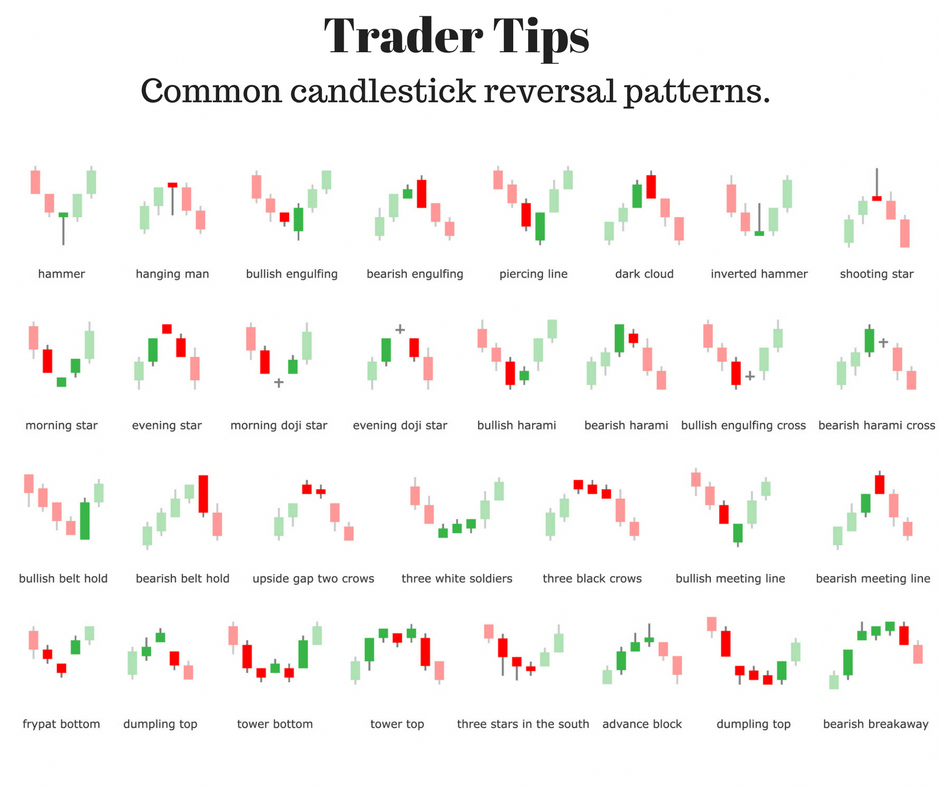

In the previous chapter, we briefly addressed the topic of candlesticks, now we will take a closer look at what candlesticks are and how you can use them for your activity as a FOREX trader. Candlesticks are originally from Japan, Steve Nison then discovered this technique for use in trade statistics.. Now let's take a look, what candlesticks are, what they tell us and what they are made of.

In the previous chapter, we briefly addressed the topic of candlesticks, now we will take a closer look at what candlesticks are and how you can use them for your activity as a FOREX trader. Candlesticks are originally from Japan, Steve Nison then discovered this technique for use in trade statistics..

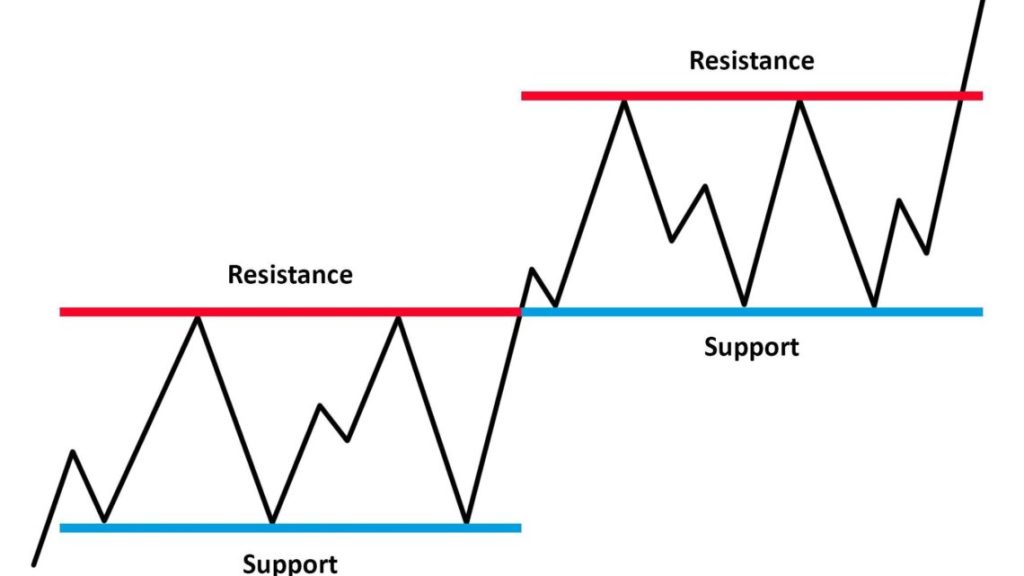

As a trader, recognizing a trend early is one of the most important tasks. The sooner we recognize a trend, the sooner we can jump on the bandwagon and the longer we can take advantage of the trend.

Support (Support) and Resistance (Resistance) is one of the most widely used concepts of FOREX chart analysis. The stranger it seems, that everyone has a different idea of it, when support or resistance occurs. Let's look at a diagram in which both situations are drawn.

In this chart we see that the price is basically in an upward trend (Bull market) is located, but there is also a tick – Zack patterns to recognize. When the price rises and then is pulled down, then we refer to the highest point previously reached as Resistance.

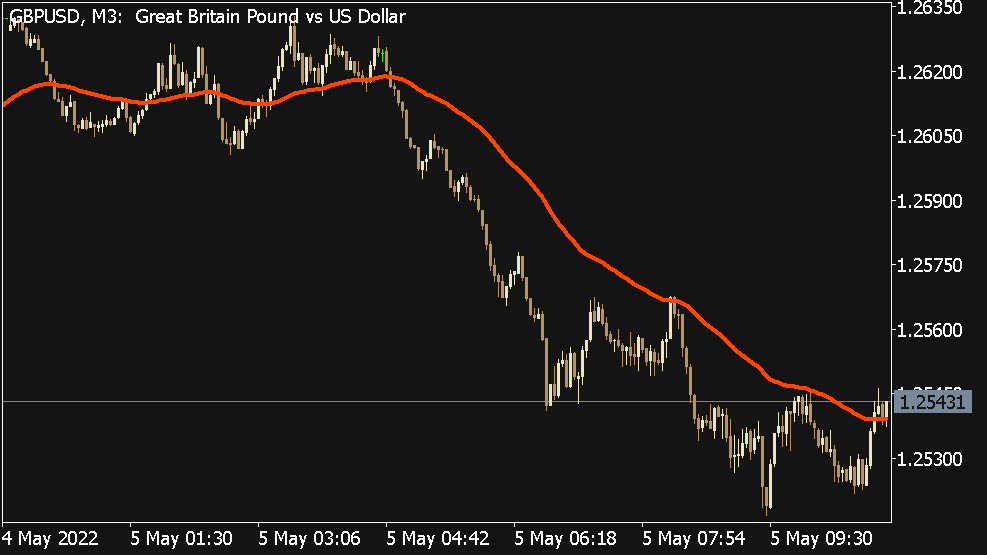

A Moving Average, on German moving average, is a method of smoothing price movements in a certain period of time. The Moving Average calculates an average of the last closing prices of a certain number of trading sections.

Like any other indicator, we also use the moving average to help anticipate future price movements. If you look at the slope of the mean, then they can take a picture of it, where the price will continue to move.

We have now discussed several tools that help us analyze charts to identify trends. There is probably already too much information to work efficiently.

In this chapter we will deal with it, how to use the different indicators rationally. You will get to know the strengths and weaknesses of each tool, so that you are able to determine which indicator is best for you and your trading plan and which are out of the question.

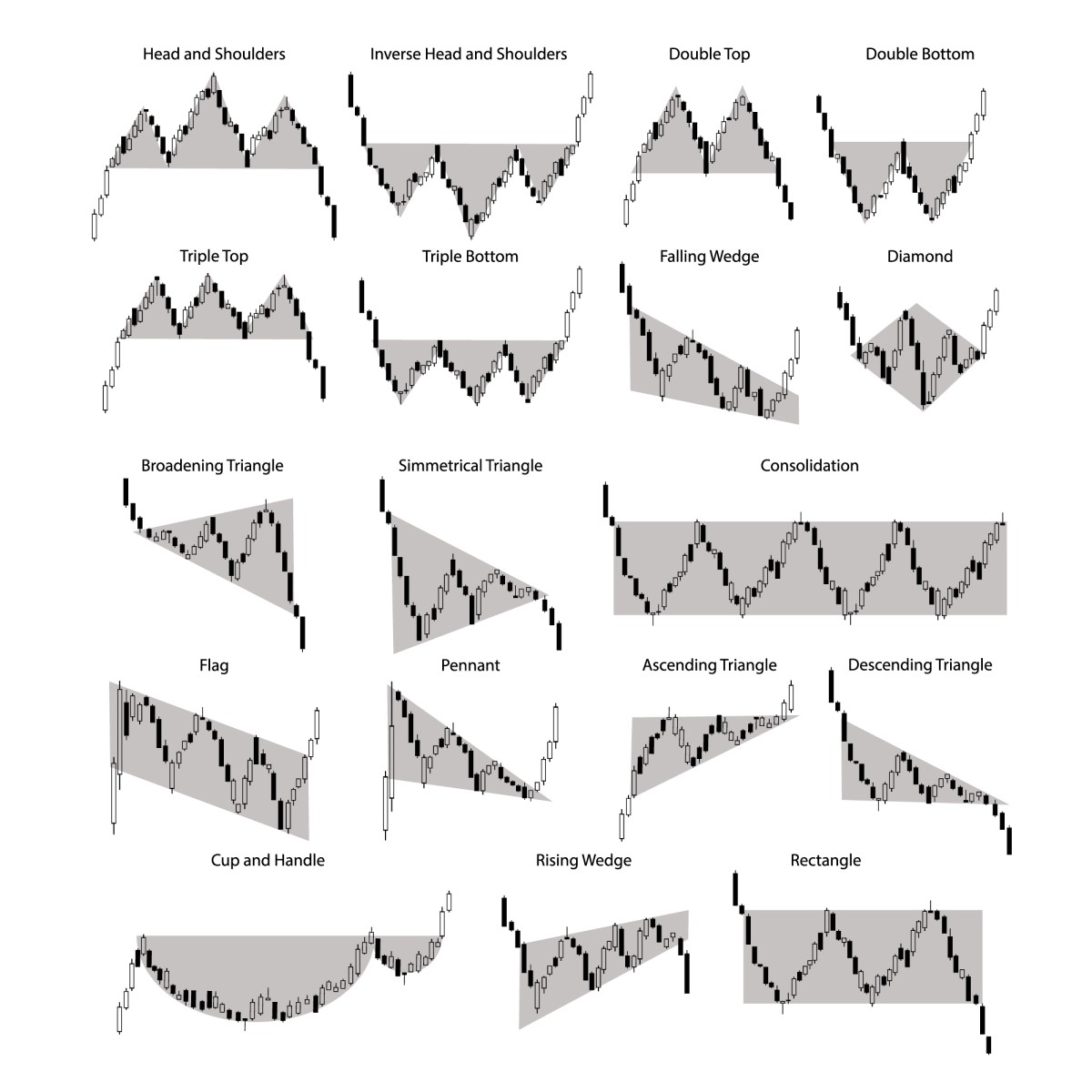

Meanwhile, there are already some tools in your FOREX- Toolbox. In this chapter we will add one more: Chart Pattern!

Let's compare chart patterns with a mine detector, if you have understood this chapter, you will be able to “Price explosion” to be recognized before it takes place. You will make a lot of money with it.

Professional traders and brokers use pivot points to identify key support and resistance levels. Pivot point would be another word for pivot (Pivot Point), on a FOREX chart it is a price level around which the prices have moved in a certain period of time. Put simply, pivots and the associated support and resistance levels are, Areas where the direction of a price movement may change.

One of the most fundamental decisions for a trader, is the choice of time frame. What I want to say is, You should plan to keep your positions open over how long you plan to keep your positions open. This time span can range from a few seconds to several months. A too small time window is often not manageable for the beginner, but especially beginners often do not have the necessary patience to trade in a larger time frame.